Corporate sector companies: SECP reports 2,956 new additions in April

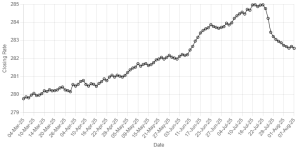

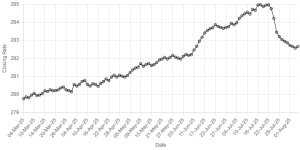

ISLAMABAD: Corporate growth accelerates as SECP reports 2,956 new additions to the corporate sector companies in April 2025 bringing the count of total registered companies in the country to 252,321, reflecting growing confidence in Pakistan’s corporate sector.

Around 99.9% of the new company registrations are now being processed digitally which, marks another step in the Commission’s efforts to provide a seamless, tech-driven regulatory environment that promotes transparency and supports ease of doing business in Pakistan. Private Limited Companies accounted for 56% of the total new registrations, while single-member companies represented 39%. The remaining 5% included public unlisted companies, not-for-profit organizations, trade organization, and limited liability partnerships (LLPs).

A closer look at sectoral growth reveals strong activity across a range of industries. The Information Technology (IT) and ecommerce sectors saw the largest growth, adding 584 new companies. The trading sector followed with 402 new companies, services with 363 new companies, Real Estate Development & Construction recorded 255 new companies. Tourism and Transport with 172, Food and Beverages with 140, Education with 131, Engineering, Fuel and Energy, and power generation with 108, Cosmetics and Toiletries, and Chemical with 102, Marketing and Advertisement with 66, Textile with 66, Mining and Quarrying with 63, Corporate Agricultural Farming with 59, Pharmaceutical with 55, Healthcare with 49 with new registrations. Other sectors contributing to this growth included Communication-allied, Auto and Allied, Sports and Allied, Tobacco, Broadcasting and Telecasting, Steel, Arts and Culture, NBFCs etc. with 341 new companies.

Foreign investment in the corporate sector also showed encouraging signs of growth, with 92 new companies receiving capital from international investors. These investors hailed from a diverse set of countries, including Bahrain, Belgium, China, Germany, Greece, Indonesia, Iraq, Kenya, Malaysia, Nepal, Nigeria, Saudi Arabia, Turkey and United States

Looking ahead, the SECP remains committed to enhancing its digital infrastructure and further simplifying business processes to foster entrepreneurship, attract investment, reduce turnaround time and drive sustainable economic growth.

Copyright Business Recorder, 2025

Comments

Comments are closed.